27+ 60 year mortgage calculator

Do not underestimate the one extra payment a year for your mortgage because. How long will it take to pay off my mortgage.

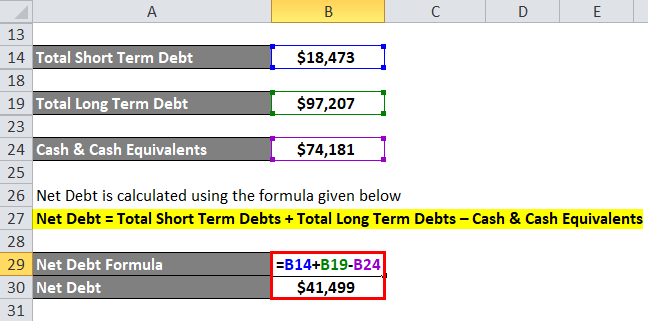

Net Debt Formula Calculator With Excel Template

Followed by a Variable Rate currently.

. Buy Your First Home. If your current rate on a 30-year fixed loan is 4000 would you like to see if you can get it lower. The Higher Value 4 year fixed LTV interest rate is available to new AIB PDH mortgage customers including Switchers borrowing at least 250000 over a term of 4 years or more.

By 1984 ARMs accounted for about 60 of new conventional mortgages closed that year exclusive of FHA VA loans. Overall cost for comparison APRC 47 APRC. Our Annual Percentage Rate Charges include valuation fees of 150 and 65 and a 60 security release fee at the end of the mortgage term.

5 year fixed closed. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. The calculator lets you find out how your.

A reverse mortgage is a mortgage loan. Our Closing Costs Study assumed a 30-year fixed-rate mortgage with a 20 down. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

This shortens their. 2022 Monthly mortgage payments. Assuming you have a 20 down payment 25000 your total mortgage on a 125000 home would be 100000.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. In 1983 39 billion in additional stock was added.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. 71 ARM refi. Any remaining available proceeds can be accessed after.

If a person. 30-Year Fixed Mortgage Principal Loan Amount. Existing Mortgage Payoff.

Mortgage amortization schedule for year 4 2025. Quickly See What Your Mortgage Payments Might Look Like. To be paid by the reverse mortgage are less than 60 of the principal limit then the borrower can draw additional proceeds up to 60 of the principal limit in the first 12 months.

Get Pre-Qualified in 60 Seconds. The start date was Jan. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

19 thoughts on Extra Payment Calculator. 5 Year Fixed Standard. Build home equity much faster.

If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time. 33360 Jun-6-2026 Payment 46 95483 62012 33472 Jul-6. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 449 monthly payment.

0 Maximum loan amount subject to LTV and Lending. People typically move homes or refinance about every 5 to 7 years. 15 yr jumbo fixed mtg refi.

The amount of money you will pay each year for this loan. Initial interest rate period. Call us today about managing your mortgage.

Use SmartAssets free California mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage. By choosing a 25-year loan term instead of a 30-year term your monthly repayments would be 267 higher but you would save.

If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190. You will spend on principal on interest. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower.

This mortgage calculator with extra payment allows you to add extra contribution to every payment. 27 2011 original loan amount 172500 and remaining balance is 94850. Were Here to Help.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. On 3 September 2013 HUD implemented Mortgagee Letter 2013-27.

5 Years fixed rate until 311027. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. We used the calculator on top the determine the results.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Buying Your Next Home. Up to five recurring or up to ten one-time lump sum payments.

To show you how this works lets compare two 30-year fixed mortgages with the same variables. Lower interest rates compared to 30-year terms. Years Principal Interest Balance.

By 1982 ARMs were widely issued with an estimated stock of 65 billion in loans by the end of the year. Extra Payment Mortgage Calculator.

8 00 18 30 H Hi Res Stock Photography And Images Alamy

27 Sample Sample Quotes In Pdf Ms Word

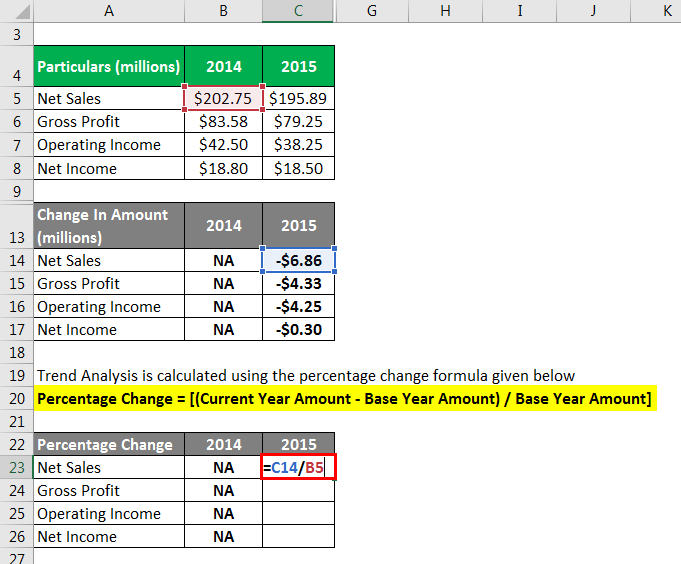

Trend Analysis Formula Calculator Example With Excel Template

27 Companies Who Hire Adults With Autism Workology

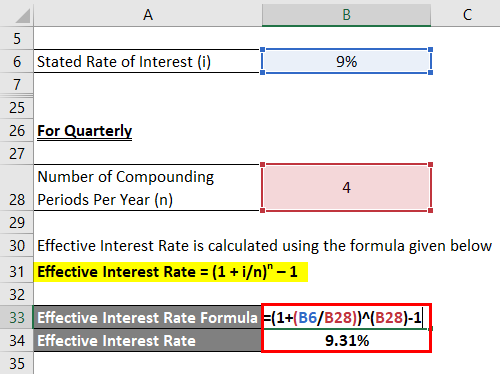

Effective Interest Rate Formula Calculator With Excel Template

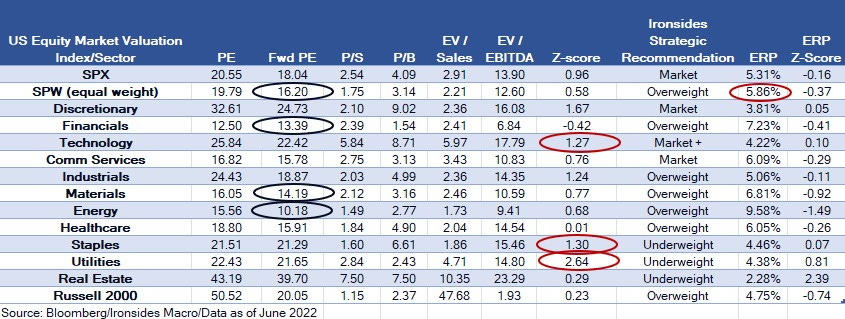

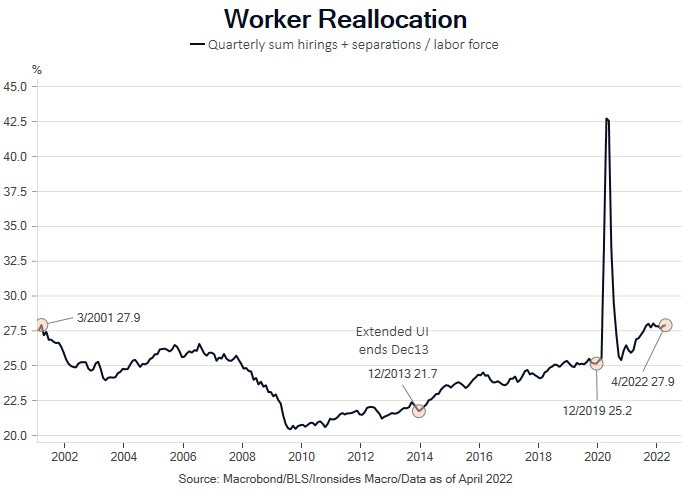

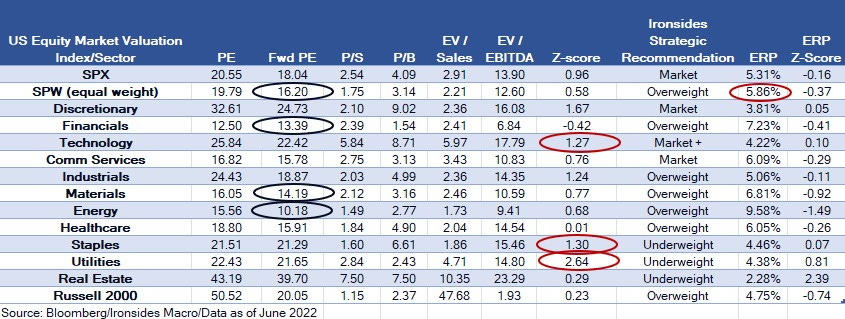

The Third Variable By Barry C Knapp

Adit Edtech Acquisition Corp 2021 Current Report 8 K

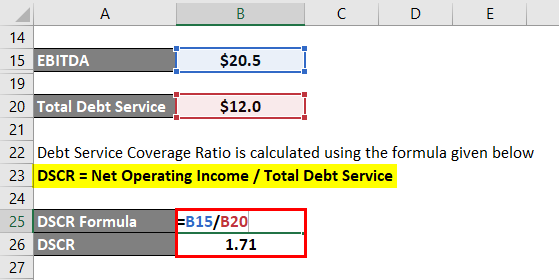

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

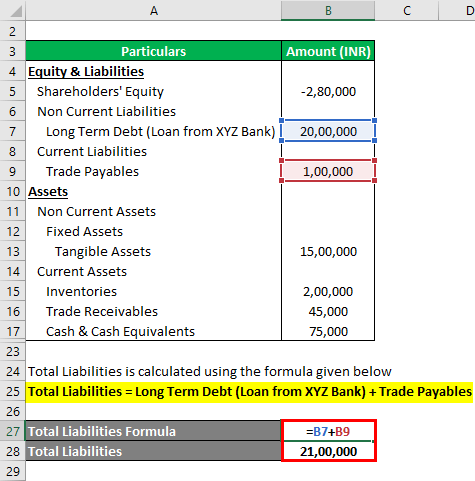

Net Asset Formula Examples With Excel Template And Calculator

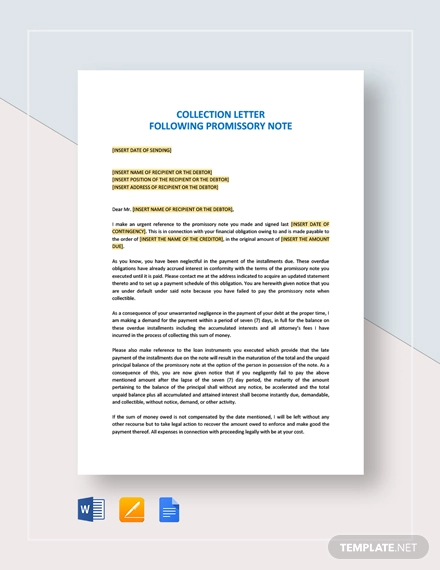

27 Simple Promissory Note Templates Google Docs Ms Word Apple Pages Free Premium Templates

The Third Variable By Barry C Knapp

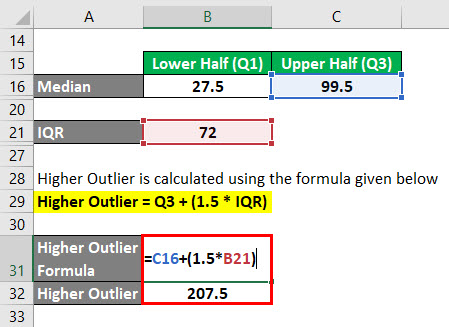

Outliers Formula How To Calculate Outliers Excel Template

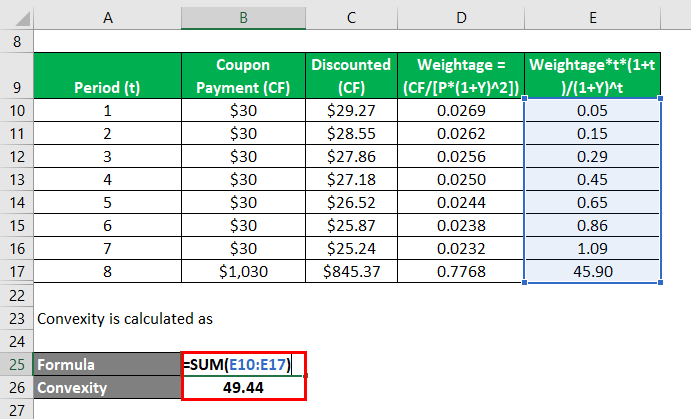

Convexity Formula Examples With Excel Template

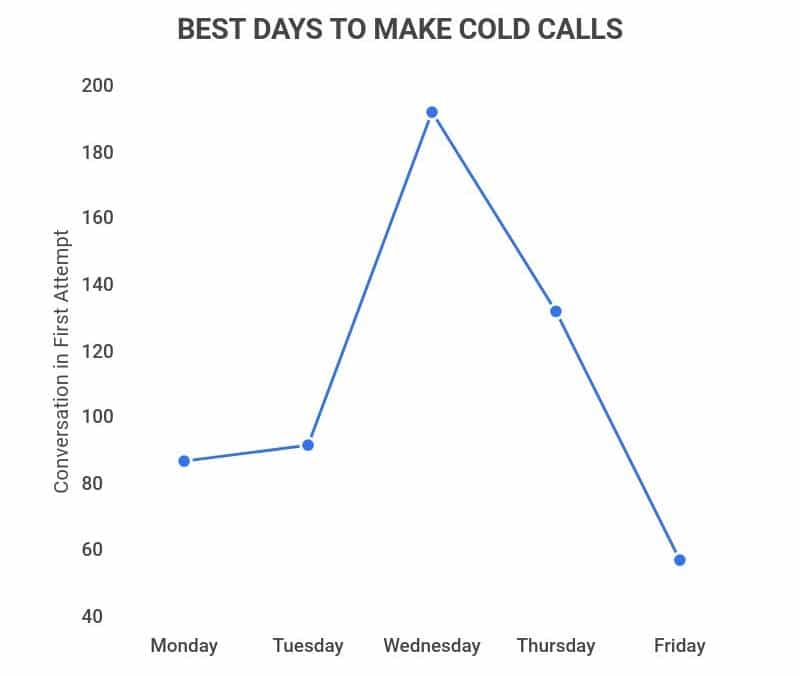

Average Cold Call Success Rate 2022 27 Cold Calling Statistics You Need To Know Zippia

Stylish Master Bedroom Design Ideas Budget 15 Largeluxurymasterbedrooms Stylish Master Bedrooms Luxurious Bedrooms Contemporary Bedroom

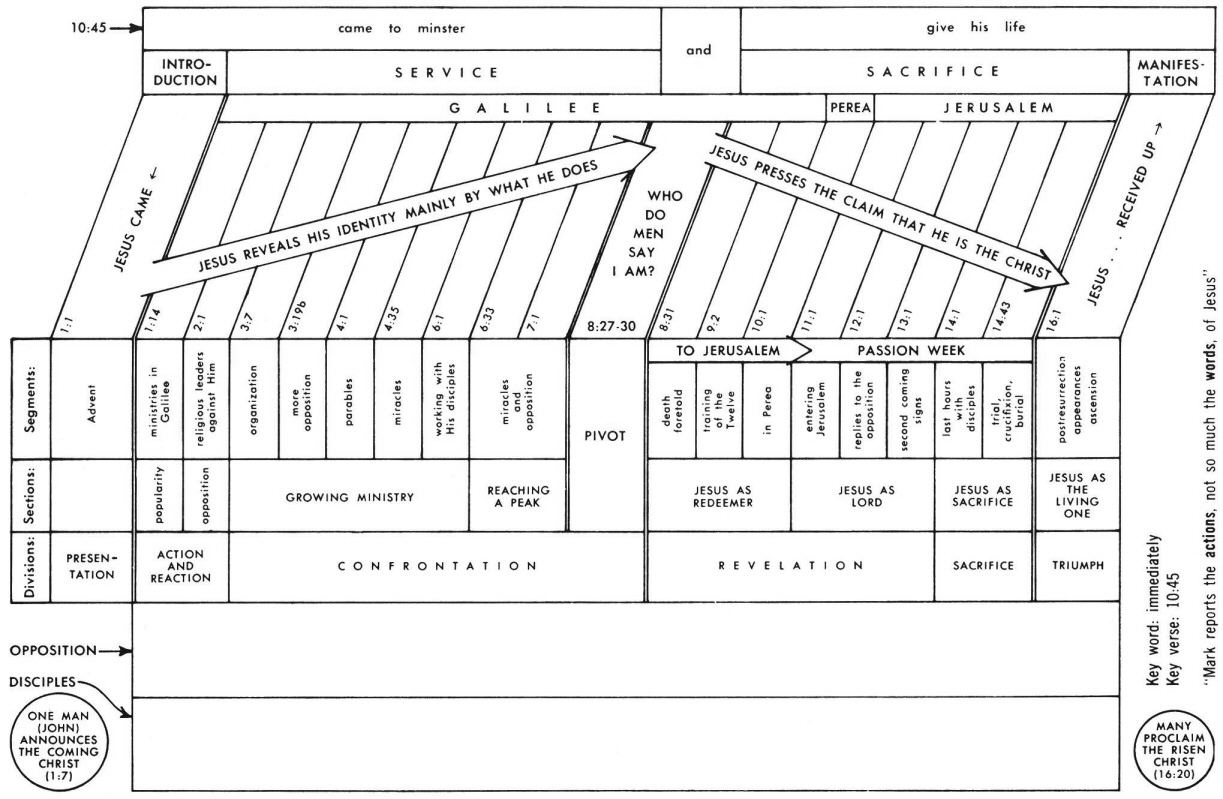

Mark 4 Commentary Precept Austin

The Third Variable By Barry C Knapp